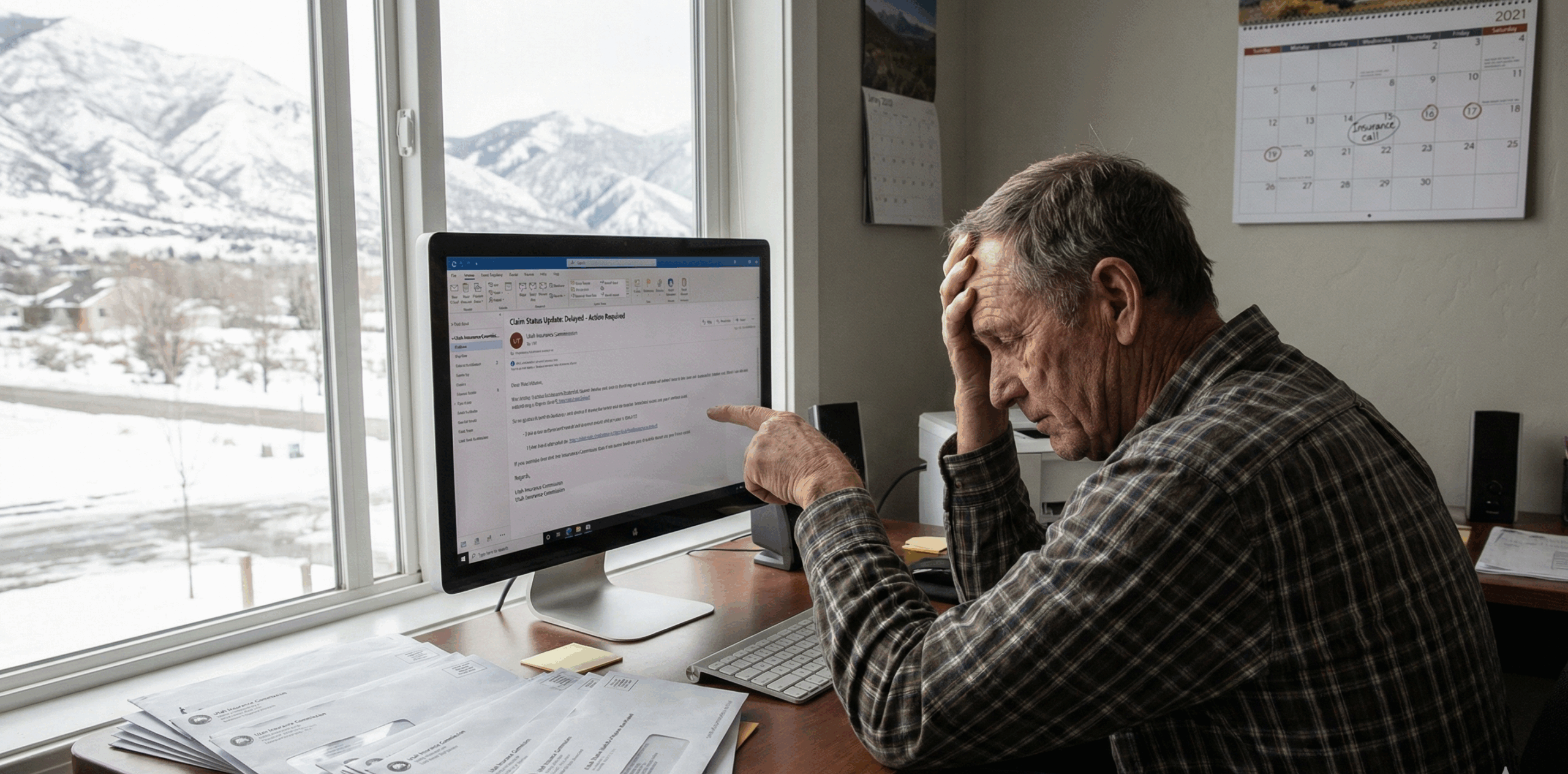

Insurance companies do not always say “no” right away. Sometimes the problem is a slow-moving claim, repeated requests for the same documents, or long gaps with no clear decision. Other times, a letter arrives that flatly denies coverage or disputes the value of your loss.

This guide explains when insurance companies delay or deny claims in Utah, what those tactics can look like in real life, and what practical steps can help you protect your position under Utah insurance rules.

Note: This is educational information, not legal advice. Insurance disputes are fact-specific, and policy language can change the outcome.

When Insurance Companies Delay or Deny Claims in Utah

In Utah, most claims start in the insurance process, not in court. That means the early outcome is often shaped by documentation, timelines, and how the insurer handles the file. A delay may be as simple as an adjuster change or missing paperwork. But a pattern of stalling can also pressure people into giving up or accepting less than the claim is worth.

If you are still working through claim basics, these related guides can help you get organized and reduce avoidable mistakes: how to file an insurance claim after an accident in Utah, understanding first-party vs third-party claims in Utah, and understanding Utah’s no-fault insurance rules.

The short video below introduces a common phrase people hear in insurance disputes and why it matters when a claim starts to stall.

Watch: Deny and Delay Tactics Explained

Key Definitions and Utah Rules That Often Matter

Most delay and denial disputes boil down to a few basics: what the policy covers, what facts can be proven, and whether the insurer is handling the claim in a fair and reasonable way.

Delay: The insurer does not make a timely decision, keeps asking for repetitive information, or leaves long gaps with no meaningful updates.

Denial: The insurer says it will not pay, either because it disputes coverage, disputes liability, or disputes the amount of loss.

Unfair claim settlement practices: Utah law lists examples of claim-handling conduct that may be considered unfair claim settlement practices, including misrepresenting policy provisions, failing to acknowledge and act promptly on communications, and not attempting good faith settlement when liability is reasonably clear. See Utah Code Section 31A-26-303.

Good faith and fair dealing: Utah recognizes a duty of good faith and fair dealing in first-party insurance relationships as an implied contractual obligation. A commonly cited Utah case is Beck v. Farmers Insurance Exchange (Utah Supreme Court, 1985).

Delays and denials also show up differently depending on the type of claim. If you are dealing with another person’s insurer, fault arguments can drive the timeline. If you are dealing with your own insurer, the dispute often centers on policy conditions and documentation. Utah’s comparative fault rules can also affect how insurers evaluate value and settlement leverage. For a Utah-focused overview, see how comparative negligence works in Utah injury claims.

The reel below reinforces a common real-world issue in denied claims: some insurers expect people to stop following up after the first “no.”

The table below summarizes how delays and denials usually show up at different stages of a claim.

| Stage of the claim | What delay or denial often looks like |

|---|---|

| Early claim intake | Slow acknowledgment, unclear adjuster assignment, repeated requests for basic information you already provided. |

| Investigation | Long gaps with no updates, broad requests that do not match the loss, pressure to give recorded statements before records are complete. |

| Decision point | Partial denials, coverage exclusions cited without clear explanation, or a low offer that ignores major categories of loss. |

| Settlement negotiations | “Take it or leave it” offers, blame-shifting, minimizing treatment or future impact, disputes about causation or fault. |

Typical Claim Steps in Utah When a File Starts to Stall

If a claim is moving normally, the process can feel routine: reporting, documentation, evaluation, and settlement. When delay appears, it helps to shift into a more structured approach so you have a clear record of what was submitted and when.

Step 1: Confirm the claim type and coverage

Make sure you know whether this is a first-party or third-party claim, and which coverages you are relying on. That choice affects proof, leverage, and what the insurer is trying to evaluate.

Step 2: Build a clean timeline

Track the date of loss, the date you reported, every document submitted, and each insurer response. A clear timeline matters when adjusters change or the story starts to drift.

Step 3: Follow up in writing

Phone calls can be useful, but written follow-up creates a paper trail. Keep it short, factual, and tied to specific requests or missing decisions.

Step 4: Ask for the specific reason

If the insurer is stalling, ask what exact item is missing and why it is needed. If there is a denial, ask what policy language is being relied on and what facts drive the decision.

Step 5: Escalate when the delay is not reasonable

Escalation can include a supervisor review, a formal appeal or dispute process (if available), a complaint with the regulator, or legal guidance if the dispute is serious.

If the claim relates to a crash, it also helps to understand pacing and why insurers may wait for treatment to stabilize. This companion guide covers common timing issues: Utah car accident claim timelines explained.

The video below describes the kinds of claim-handling tactics that can slow down a fair resolution and what people typically do next.

Watch: Delay, Deny, Defend Tactics and Practical Responses

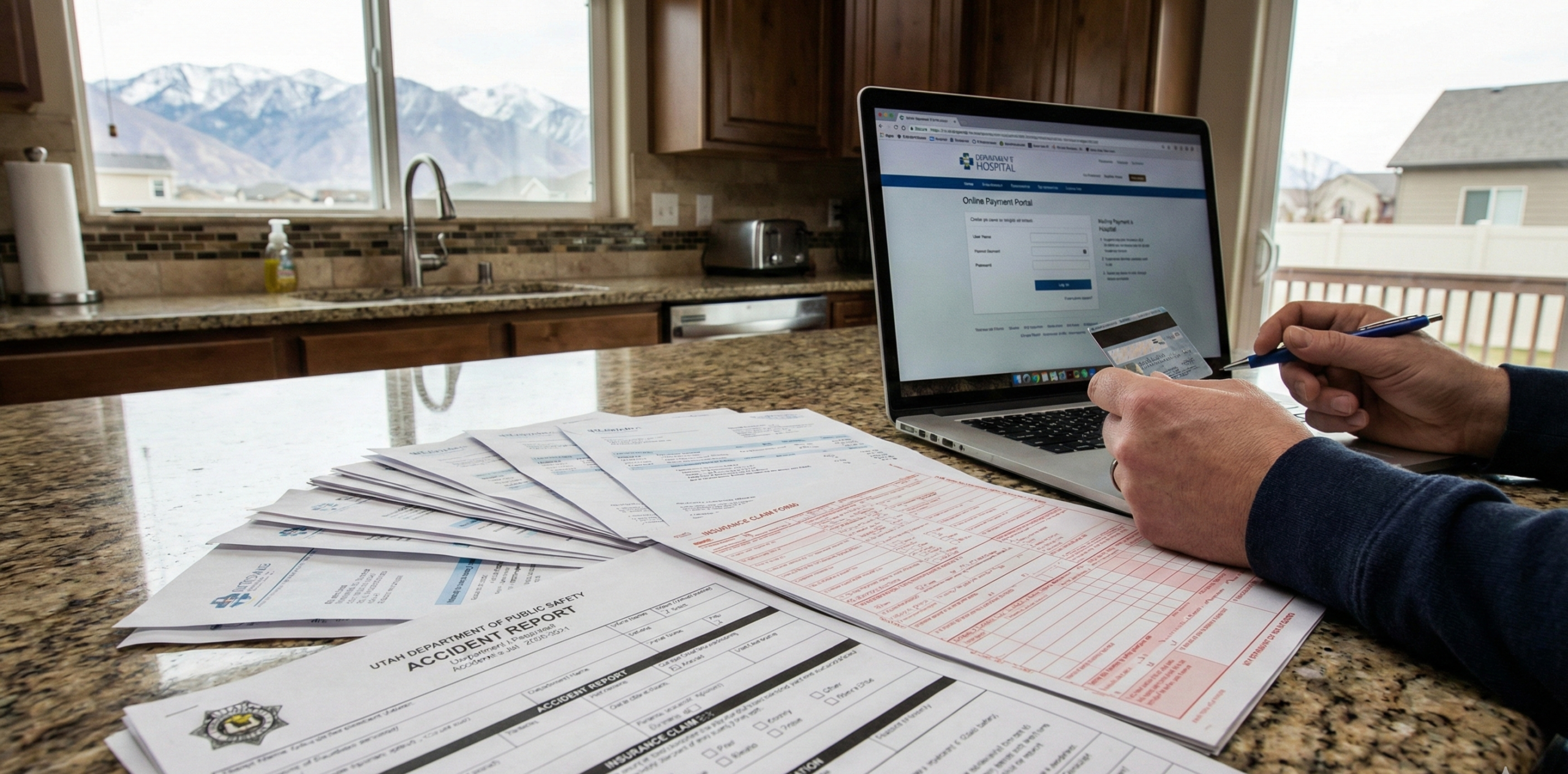

Documentation That Usually Helps Break a Delay Pattern

Most delays get worse when records are scattered. The goal is to make the file easy to evaluate: what happened, what it cost, and what remains disputed. You do not need a complex system, but you do need consistency.

Claim basics: claim number, adjuster name, insurer contact info, date of loss, and a short factual summary of what happened.

Proof of loss: photos, estimates, invoices, receipts, repair records, and any documents showing pre-loss condition when relevant.

Medical and wage records: visit summaries, bills, treatment notes, work restrictions, time missed, and wage statements when injury is involved.

Communication log: dates of calls and emails, what was requested, what was sent, and what response was given.

Denial materials: denial letter, cited policy language, and any referenced investigation documents.

When adjuster communication is part of the problem, it helps to know what questions to ask and what information to keep in writing. This related guide can help: dealing with insurance adjusters in Utah.

The Instagram clip below discusses policyholder options after a denial and reinforces a key point: you usually need a clear record of what you asked for and what the insurer said in response.

Common Mistakes That Can Make a Delay or Denial Worse

Many claim problems are not caused by one big mistake. They come from small choices that create confusion, weaken proof, or give the insurer an easy reason to say “we still can’t evaluate this.”

Assuming the insurer has everything: If you do not confirm what was received, you may find out weeks later that key documents never made it into the file.

Letting the story change: Inconsistent timelines or offhand comments can become “disputes” later. Keep your description factual and consistent.

Rushing recorded statements: If you are asked to give a recorded statement, avoid guessing. Stick to what you know and do not fill gaps with assumptions.

Not documenting damages fully: If a loss is not documented, it is easy for an adjuster to minimize or ignore it. Keep bills, estimates, receipts, and wage proof organized.

Waiting too long to escalate: If weeks go by with no meaningful movement, a structured escalation can prevent the claim from drifting indefinitely.

What to Do After a Denial or Long Delay

A denial is not always the end of the road, and a delay is not always harmless. The right next step depends on the policy, the type of claim, and the reason the insurer gives. The most practical approach is usually a steady, documented escalation.

Ask for a clear written explanation

Request the specific reason for the delay or denial, the documents the insurer relied on, and the policy provisions being cited.

Respond with targeted documentation

If the insurer says something is missing, provide it in a single organized packet and confirm receipt. This reduces “we are still waiting” excuses.

Use a supervisor review when the file is stuck

If the adjuster is not responding or the reasons keep shifting, ask for a supervisor review and keep the request in writing.

Consider a complaint to the Utah Insurance Department

Utah’s regulator provides a complaint portal for consumers. A complaint can be a practical step when communication breaks down or you need the file reviewed.

Get legal guidance if the dispute is serious

If the denial appears unsupported, the delay is significant, or the value at stake is high, a legal review can clarify whether the issue is coverage, fault, valuation, or claim handling.

The video below focuses on why denials happen and the practical steps people often take to push toward a fair resolution.

Watch: Why Insurers Deny Claims and What You Can Do Next

This Utah-related Instagram reel highlights how high-stakes disputes can arise when claims are refused, and why keeping a clean record matters from the start.

Next Steps

If you are dealing with delays or a denial, focus on Utah-appropriate steps that keep the process evidence-driven and organized.

Get your documents in one place: Create one folder for claim communications, bills, estimates, and proof of loss.

Write a simple timeline: Date of loss, report date, what you submitted, and when the insurer responded.

Ask for the insurer’s position in writing: If the claim is delayed, ask what is missing. If denied, ask for the policy language and facts being relied on.

Stay consistent and factual: Avoid guessing. If you do not know, it is better to say so than to fill gaps with assumptions.

Escalate when the file is not moving: Supervisor review, regulator complaint, or legal guidance can be appropriate depending on the dispute.

Talk to Gibb Law Firm About a Utah Insurance Delay or Denial

Gibb Law Firm is a Utah-based law firm focused on clear, practical guidance for people navigating stressful legal and insurance problems. If you are dealing with a stalled claim, a denial letter, or a settlement offer that does not match your documented loss, we can help you understand your options and next steps under Utah law.

Schedule a Consultation