Utah is often described as a “no-fault” state, but that phrase can be confusing. In plain terms, no-fault usually refers to Personal Injury Protection (PIP) benefits, which are designed to help pay certain accident-related medical costs through your own insurance first, regardless of who caused the crash.

At the same time, fault still matters in many real-world situations. It can affect vehicle damage claims, injuries that go beyond PIP, and how much compensation may be available if you pursue a claim against another driver.

If you need immediate next-step guidance after a crash, start with what to do after a car accident in Utah. For a related concept that often overlaps with no-fault questions, read how fault is determined in Utah car crashes. You can also explore more Utah legal resources on Gibb Law Firm’s website.

Note: This article is educational information, not legal advice. Insurance deadlines and coverage terms can be strict, and outcomes depend on the facts and the insurance policies involved.

Understanding Utah’s No-Fault Insurance Rules

Utah’s no-fault structure is built around PIP coverage. The main idea is speed and stability. Instead of waiting for fault to be decided before any help is available, PIP is intended to provide early coverage for certain accident-related expenses.

No-fault usually means PIP first: For many injury-related bills, your own insurance may be the starting point.

You can step outside no-fault in serious cases: Utah law includes a serious injury threshold that can allow a claim for general damages in certain situations.

Fault still matters: Comparative negligence can affect claims beyond PIP, including how responsibility is split when more than one person may share blame.

Documentation drives outcomes: Records, timelines, and consistency help when an insurer questions causation, treatment, or severity.

| Question people ask | How Utah’s no-fault concept typically applies |

|---|---|

| Who pays my first medical bills? | PIP is often the starting point for certain accident-related injury expenses, regardless of who caused the crash. |

| Can I still pursue the at-fault driver? | In some cases, yes. Utah has a “serious injury threshold” that can allow claims for general damages under specific conditions. |

| Does fault matter at all? | Yes. Fault often impacts property damage, liability beyond PIP, and how compensation may be reduced under comparative negligence. |

| Is “no-fault” the same as “no lawsuit”? | No. No-fault is a framework for how certain benefits are accessed, not a blanket rule that prevents every claim. |

The short video below connects Utah’s no-fault PIP system with comparative negligence, which is a common source of confusion for people after a crash.

Watch: Utah No-Fault PIP and Comparative Negligence

Key Definitions and Utah Statutes

No-fault rules are easiest to understand when you separate two ideas: first, how PIP benefits work; and second, when a claim goes beyond PIP and becomes a fault-based dispute.

Personal Injury Protection (PIP): A type of coverage intended to help pay certain injury-related costs through your own insurer first, regardless of fault.

General damages: A broad term that can include pain and suffering and other non-economic harm. Utah restricts when these can be pursued after an auto accident unless a serious injury threshold is met.

Serious injury threshold: Utah Code explains conditions that can allow a person to pursue general damages after an auto accident, such as specific categories of injury and medical expenses over a defined amount. See Utah Code 31A-22-309.

Comparative negligence: Utah follows a modified comparative negligence framework that can reduce recovery based on a person’s percentage of fault. See Utah Code 78B-5-818.

The Instagram reel below is a real-world example of how PIP may apply early after a crash, including the commonly discussed minimum medical benefit figure.

If you want to understand the threshold concept in plain English, start here: no-fault does not always stop a claim. It mainly controls how the first layer of benefits is accessed, and when a larger claim may be allowed under Utah law.

Typical Claim Steps Under Utah’s No-Fault Framework

In most cases, the early part of a Utah car accident claim is administrative and insurance-driven. That means your first steps are about preserving evidence and triggering coverage correctly, not proving fault on day one.

Step 1: Get medical evaluation and keep records

Medical notes, treatment plans, and billing summaries are often the foundation of a PIP claim and later injury discussions.

Step 2: Notify the insurer and open a claim

Most policies require prompt notice. Ask what documentation is needed for PIP benefits and how bills should be submitted.

Step 3: Submit bills and track payments

Organize invoices, Explanation of Benefits (if applicable), and payment logs so you can spot delays or gaps quickly.

Step 4: Evaluate whether the case goes beyond PIP

When injuries are more serious, you may need to evaluate the serious injury threshold and whether fault-based claims make sense.

Step 5: Address fault issues if a larger claim is pursued

If you move beyond PIP, evidence of negligence, comparative fault, and damages becomes central to negotiations or litigation.

The video below explains Utah’s minimum PIP medical coverage and how PIP applies after a crash regardless of who is at fault.

Watch: Utah PIP Minimum Coverage and How It Works

The reel below highlights how limited coverage can create pressure points in a claim, especially when medical costs rise quickly after an accident.

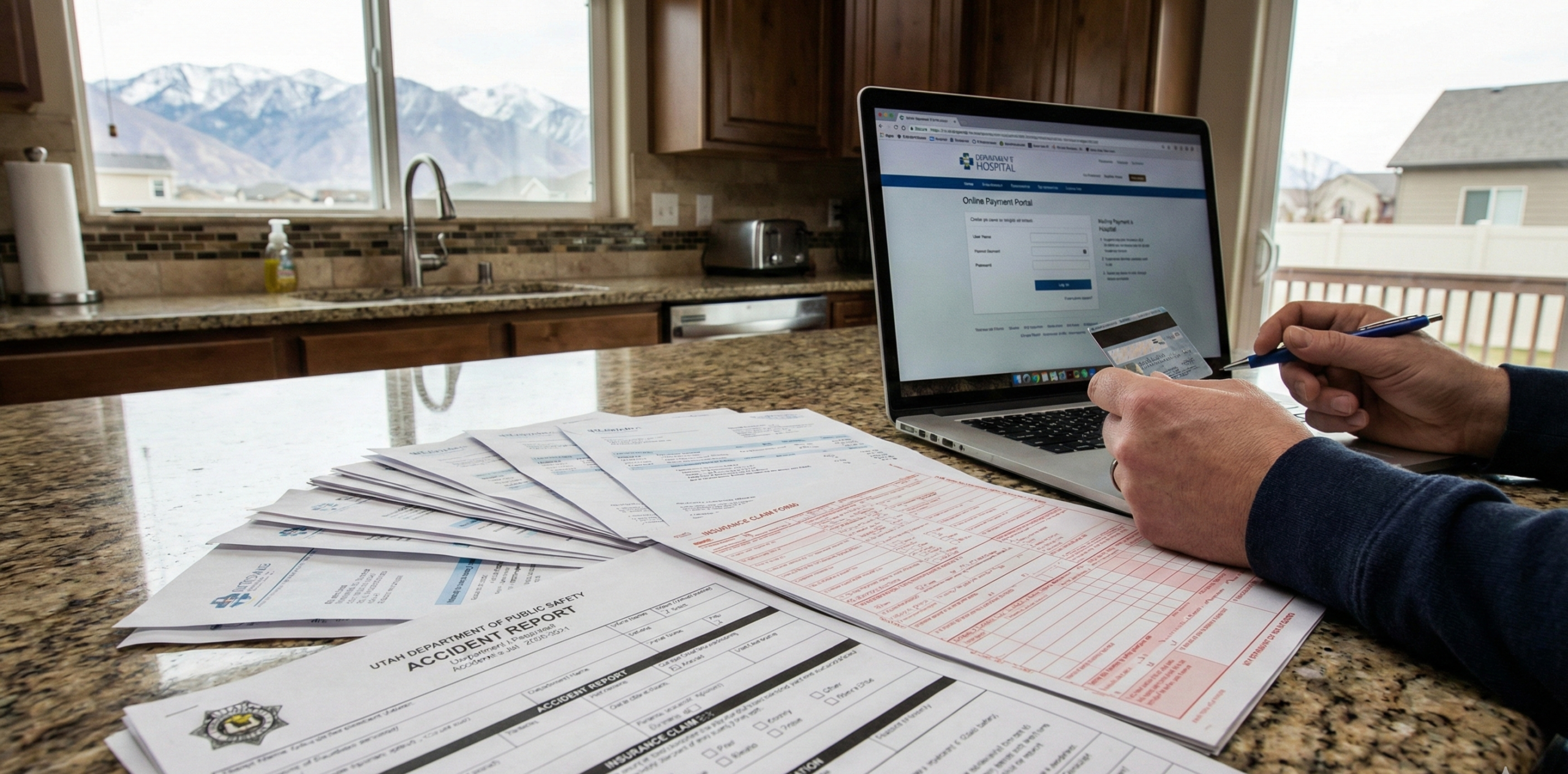

Records and Paperwork That Often Matter

No-fault claims are won or lost on documentation. The exact forms vary by insurer, but most PIP processes require you to provide consistent, organized proof of treatment and expenses.

PIP application and insurer forms: Many carriers use their own forms to open or confirm PIP benefits and coordinate billing.

Medical records and itemized bills: Keep provider notes, diagnosis codes, referrals, and billing summaries in one place.

Wage and work-impact verification: If an insurer requests confirmation of missed work, employer documentation can matter.

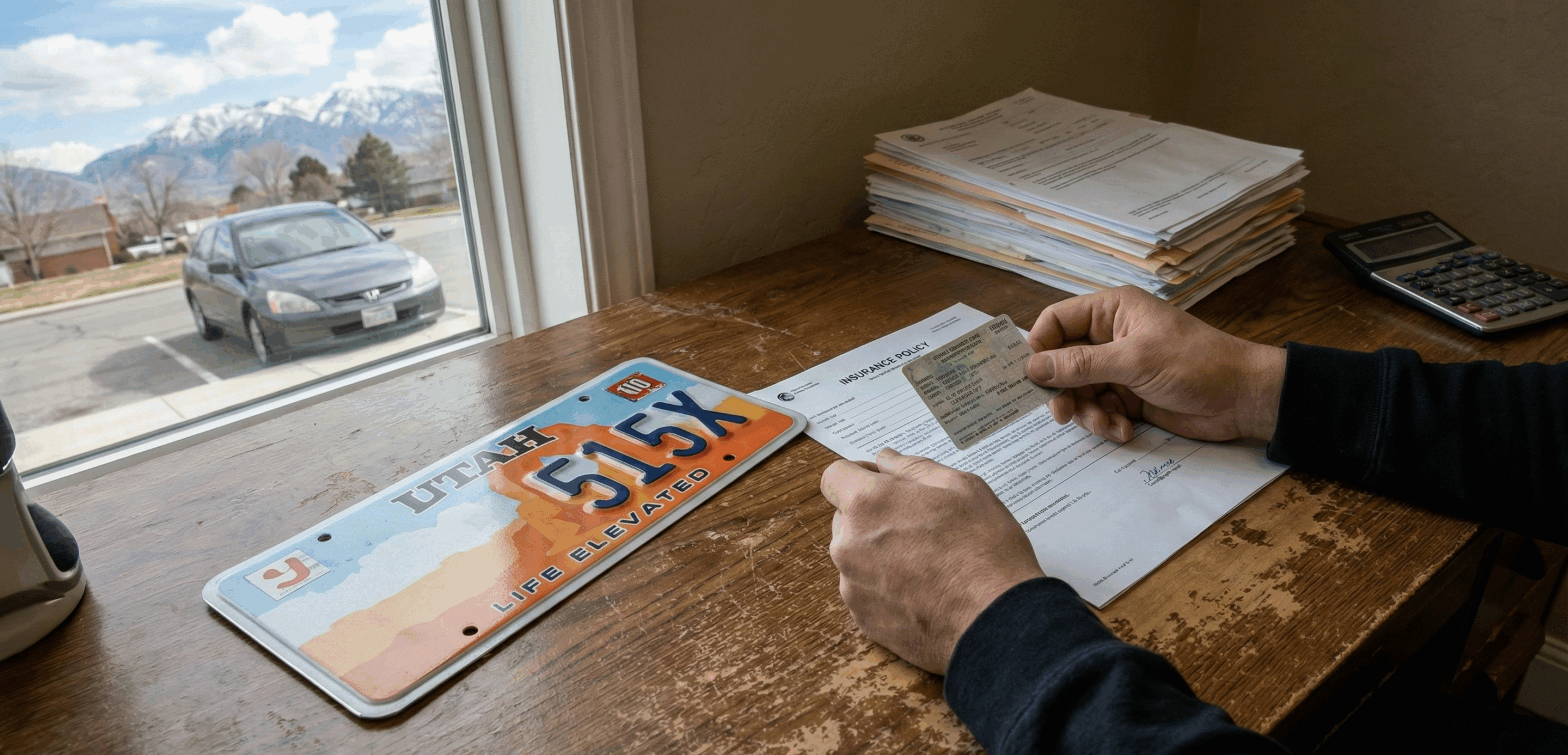

Crash documentation: Photos, witness names, and the crash report can become important if the matter later turns into a fault dispute.

Even when you are focused on no-fault benefits, it can still help to follow strong crash documentation basics. If you have not already, review what to do after a car accident in Utah and save copies of everything you submit to an insurance company.

Common Mistakes to Avoid

Most problems in no-fault claims come from confusion about what PIP covers, missed documentation, and assumptions that the insurance process will automatically “sort it out.” A careful, consistent approach helps protect your claim.

Assuming no-fault means fault does not matter: Fault may still affect property damage disputes and any claim that goes beyond PIP.

Waiting too long to get treatment: Delays can lead to arguments about whether symptoms were caused by the crash.

Failing to track bills and submissions: If you cannot show what was sent and when, it becomes harder to challenge denials or delays.

Giving inconsistent statements: Differences between a recorded statement, the crash report, and medical notes can be used to question credibility.

Overlooking comparative negligence risk: If a claim moves beyond PIP, Utah’s comparative negligence rules can reduce recovery based on fault percentages.

The video below gives a general explanation of no-fault insurance and what it means to claim through your own insurer first.

Watch: No-Fault Insurance Explained

The reel below helps clarify how PIP fits alongside other types of auto insurance that may apply after a collision.

Next Steps if You Have Questions About No-Fault Coverage

If you are unsure how PIP applies to your situation, the safest approach is to get organized and clarify coverage early. That helps you avoid missed submissions and reduces the chance of preventable disputes later.

Request a clear explanation of your PIP process: Ask the insurer what they need, where to send it, and how they confirm receipt.

Build a simple claim folder: Keep bills, records, claim numbers, adjuster communications, and a timeline in one place.

Track symptoms and treatment: Consistency between your treatment notes and what you report is often important in disputes.

Evaluate fault issues if the claim becomes larger: If you believe another driver caused the crash and the injuries are serious, evidence and comparative negligence become more important.

Talk to Gibb Law About a Utah Car Accident Claim

Gibb Law is a Utah-based law firm focused on clear, practical guidance for clients facing real-world legal problems. If you are dealing with no-fault coverage questions after a crash, we can help you understand how Utah’s rules apply, what documentation insurers typically expect, and what options may fit your situation.

Schedule a Consultation