Insurance claim language can feel simple until you are the one dealing with an adjuster, a deadline, or a denial. One of the most important basics to get right is whether you are making a first-party claim or a third-party claim under Utah insurance rules.

This guide explains understanding first-party vs third-party claims in Utah, what each type usually involves, and what practical steps help protect your position. If your questions started after a crash, you may also want to review what to do after a car accident in Utah and understanding Utah’s no-fault insurance rules.

Note: This is educational information, not legal advice. Insurance disputes are fact-specific, and coverage language can change the outcome.

Understanding First-Party vs Third-Party Claims in Utah

In plain English, a first-party claim is a claim you make with your own insurance company under a policy you pay for. A third-party claim is a claim you make against someone else’s insurance, usually because you believe that person is legally responsible for your loss.

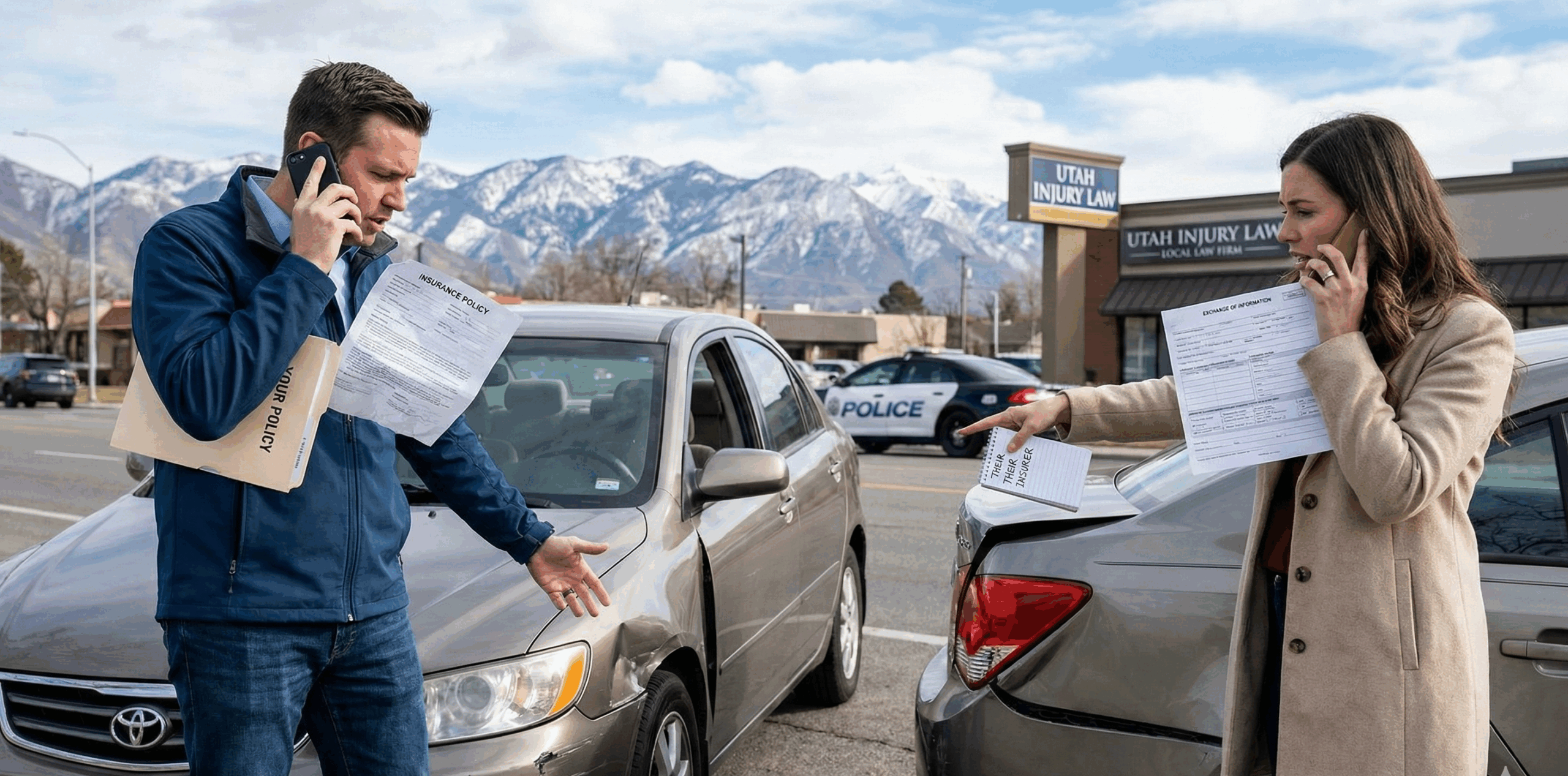

Both claim types can show up after the same event. For example, after a car accident you might use your own coverages right away (first-party) while also pursuing the at-fault driver’s carrier for additional losses (third-party). Understanding the difference matters because the timelines, proof, and negotiation dynamics are not always the same.

The video below gives a helpful, high-level explanation of how first-party and third-party claims commonly work, especially in auto insurance situations.

Watch: First-Party vs Third-Party Claims Basics

Key Definitions and Utah Rules That Usually Matter

Utah claim outcomes often come down to a few core issues: what coverage applies, what proof is available, and whether any deadlines or policy conditions are being missed.

First-party claim: A claim you make under your own policy, such as personal injury protection (PIP), medical payments coverage (if included), uninsured or underinsured motorist coverage, or property coverages depending on the policy.

Third-party claim: A claim made against another person or business’s liability insurance. The insurer defends its insured and evaluates whether it must pay based on liability and damages.

Liability: Who is legally responsible. Utah applies comparative fault concepts in many injury cases. If you want a Utah-focused overview, see how comparative negligence works in Utah injury claims.

Damages: The losses being claimed, such as medical bills, lost income, and pain and suffering. For a practical framework, see calculating damages in a Utah car accident case.

In many situations, the biggest difference between claim types is not the paperwork. It is the insurer’s role. In a first-party claim, your insurer is evaluating your coverage and your claimed loss. In a third-party claim, the insurer is evaluating whether its insured is responsible and what it should pay to resolve the claim.

This reel provides a quick refresher on the basic difference between claim types, which helps frame the rest of the steps in this guide.

The table below summarizes the practical differences people usually feel when these claims are actually in motion.

| Topic | What typically differs |

|---|---|

| Who you are dealing with | First-party: your insurer under your policy. Third-party: the other side’s insurer defending its insured. |

| What you must prove | First-party: coverage and the amount of loss. Third-party: fault (liability) and damages. |

| Common pressure point | First-party: policy conditions, documentation, and claim handling. Third-party: disputes about fault, value, or causation. |

| Settlement dynamics | First-party disputes can center on what the policy requires. Third-party settlements often revolve around negotiation leverage and litigation risk. |

Typical Claim Steps in Utah

Whether a claim is first-party or third-party, most people benefit from the same early habits: document the facts, preserve records, and avoid rushed statements. From there, the steps often branch depending on which type of claim you are making.

Step 1: Identify the policy and coverage

First-party claims require you to know what coverages you carry. Third-party claims require you to identify the at-fault party and their insurer.

Step 2: Report the claim and create a paper trail

Get a claim number, confirm contact info, and follow up in writing when possible so key details do not get lost.

Step 3: Build proof early

Photos, repair estimates, medical records, wage documentation, and witness details can matter more than people expect.

Step 4: Track timelines

Delays can hurt leverage. A clear timeline also helps when adjusters change or disputes arise.

Step 5: Negotiate or escalate if needed

Some claims resolve through routine negotiation. Others require formal disputes, attorney involvement, or litigation when reasonable resolution is not offered.

If your situation involves a vehicle collision, this companion resource helps you understand typical deadlines and pacing: Utah car accident claim timelines explained.

The video below expands the discussion beyond auto insurance and helps explain how first-party and third-party claims show up across different insurance contexts.

Watch: First-Party vs Third-Party Claims Across Insurance Types

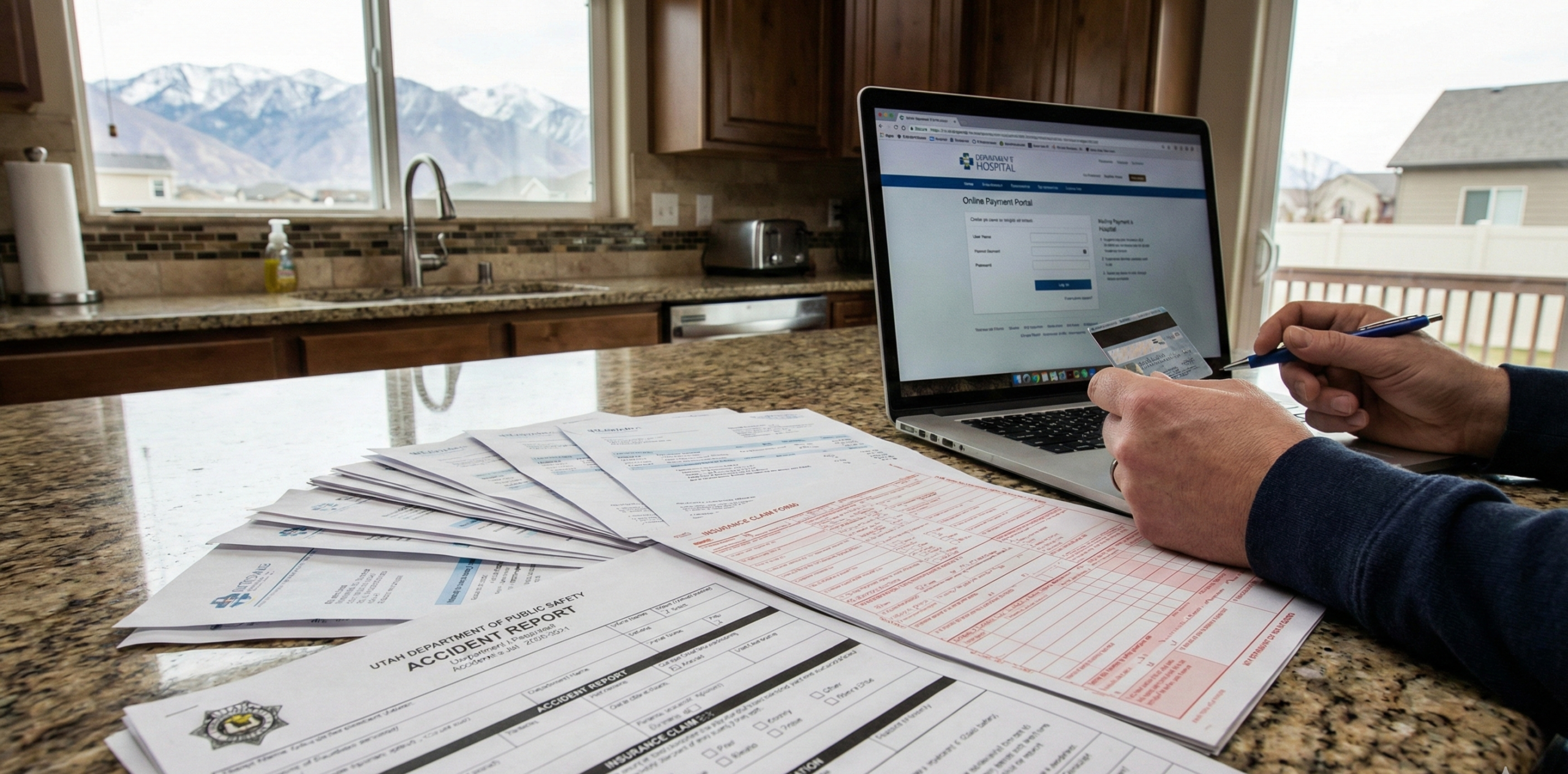

Common Forms and Documentation You May Need

Most claim disputes are decided by documentation, not opinions. The goal is to keep things simple: prove what happened, prove what it cost, and make it easy for a reasonable adjuster to understand your position.

Claim report information: claim number, adjuster contact, date and location of loss, and a short description that matches the known facts.

Accident or incident documentation: police report (when applicable), photos or video, witness names, and any scene notes.

Medical documentation: visit summaries, bills, and treatment notes when injury is involved.

Repair and property documentation: estimates, receipts, invoices, and proof of pre-loss condition when relevant.

Wage loss documentation: employer statements, time missed, pay stubs, and any disability or leave records.

This Instagram video focuses on third-party claim concepts and can be useful if you are trying to understand why another person’s insurer may push back even when you feel the situation is clear.

Common Mistakes to Avoid

Most insurance mistakes are not dramatic. They are small, avoidable decisions that quietly reduce claim value or create confusion later.

Not clarifying the claim type early: If you treat a third-party claim like a first-party claim (or the reverse), you may miss key proof needs or negotiation realities.

Giving rushed recorded statements: It is easy to guess, assume, or phrase something poorly. Stick to facts you know and keep answers accurate.

Under-documenting damages: Keep a clean file of bills, receipts, time missed from work, and out-of-pocket costs.

Overlooking comparative fault issues: In third-party claims, adjusters often look for fault arguments. Know that partial fault can affect recovery.

Waiting too long to get help: When a claim stalls or a denial appears questionable, early legal guidance can prevent your options from narrowing.

If adjuster communications have become stressful or confusing, this related resource may help you reset the basics before responding: dealing with insurance adjusters in Utah.

This reel gives broader context on the overall claims process, which helps explain why documentation and steady follow-up matter for both first-party and third-party claims.

How Third-Party Claims Usually Work in Practice

Third-party claims often feel slower because the insurer is not evaluating “your coverage.” It is evaluating whether its insured is responsible and how much it must pay to resolve the claim. That usually means more scrutiny on fault and damages.

In many cases, the insurer will request documentation, investigate liability, and then make an offer if it believes its insured is responsible. If you disagree about fault or value, negotiation can follow. If negotiation fails, litigation may become the leverage point that forces a more realistic evaluation.

The video below is a straightforward primer on third-party claims and what it generally means to pursue compensation through another person’s insurance.

Watch: Third-Party Claims Explained

Next Steps

If you are trying to protect your claim and reduce stress, focus on practical, Utah-appropriate steps that keep the process organized and evidence-driven.

Confirm which claim you are making: First-party, third-party, or both. Write it down so your follow-ups stay consistent.

Organize your file: Keep one folder for photos, estimates, bills, and communications. A clean record helps negotiations move faster.

Track deadlines and responses: Note when you submitted documents and when the insurer replied. If a claim stalls, that record matters.

Be careful with statements: Be accurate, avoid guessing, and do not downplay symptoms or losses if injury is involved.

Get legal guidance when needed: If liability is disputed, damages are significant, or you are facing a denial or delay, a consult can clarify next steps under Utah law.

Talk to Gibb Law Firm About a Utah Insurance Claim

Gibb Law Firm is a Utah-based law firm focused on clear, practical guidance for people navigating stressful legal and insurance problems. If you are unsure whether your situation is a first-party or third-party claim, or you are dealing with delays, denials, or low settlement offers, we can help you understand your options and next steps.

Schedule a Consultation