After an accident, the first worry is often health and safety. The next worry is usually the same question: Who pays the medical bills and when?

In Utah, medical bills after a crash are often handled through a combination of auto insurance (including no-fault benefits), health insurance, and—when appropriate—an injury claim against the at-fault party. This guide explains the typical order of payments, what paperwork matters, and the common mistakes that can make bills harder to resolve.

Note: This article is for educational purposes and is not legal advice. Each case depends on the policy language, the injuries, and the facts of the accident.

Overview of How Bills Are Paid After Utah Accidents

Most Utah accident billing questions come down to three moving parts: what coverage exists, what must be used first, and how reimbursement works when there is a settlement.

If you want a broader step-by-step overview of the claims process, start with our guide to filing an insurance claim after an accident in Utah. If you are already dealing with an adjuster, our article on dealing with insurance adjusters in Utah can help you avoid common pressure tactics.

The video below explains a common Utah issue: whether health insurance or auto insurance pays first, and how no-fault benefits can affect early medical billing.

Watch: Do Health Insurance or Auto Benefits Pay First

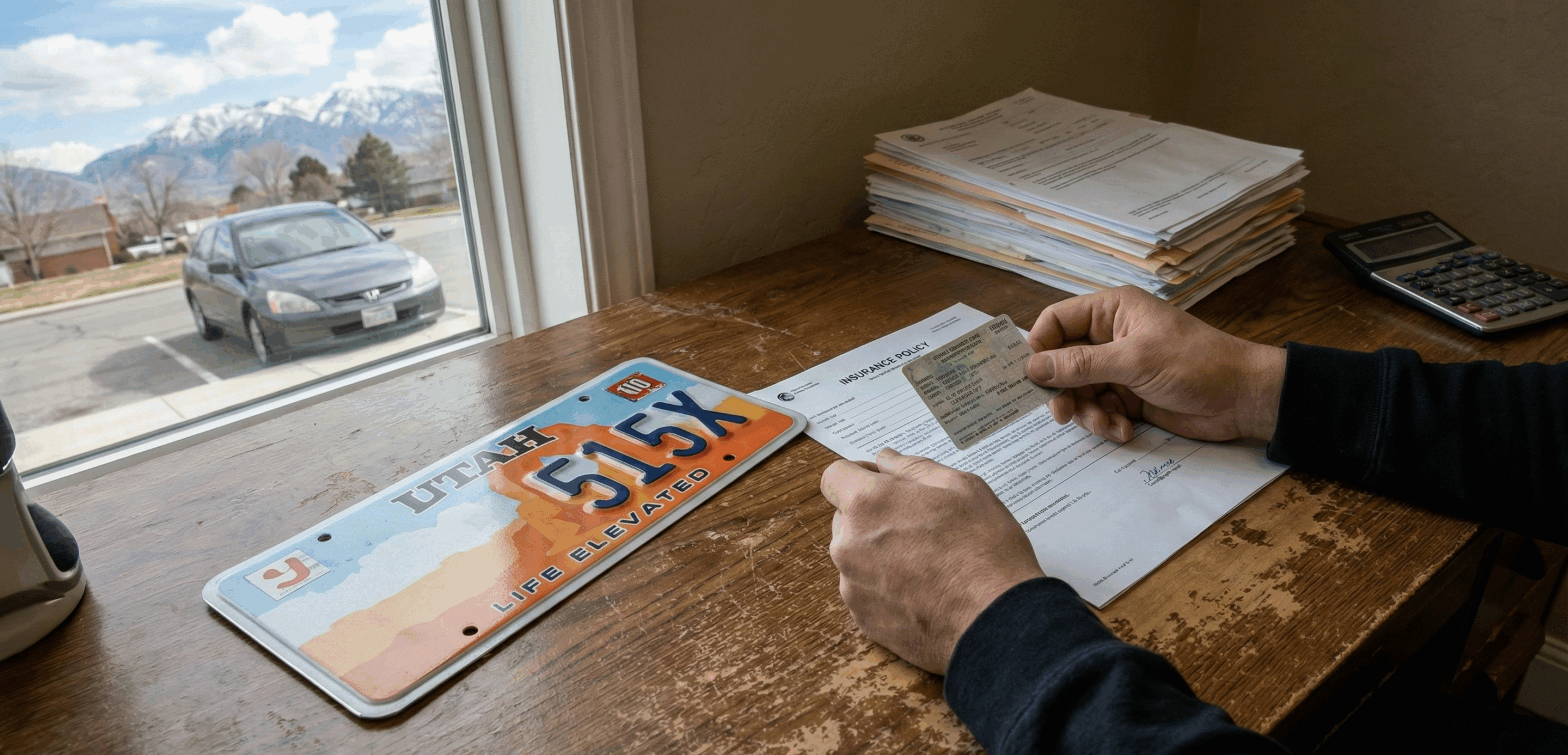

Key Definitions and Utah Rules That Affect Medical Bills

Insurance terms can sound technical, but they shape what happens to your bills. In many Utah vehicle crashes, no-fault benefits are used early in the process, even before fault is fully sorted out.

Personal Injury Protection PIP: A no-fault benefit in many auto policies that can pay certain medical expenses and related losses after a crash, regardless of who caused it.

MedPay Medical Payments Coverage: Optional coverage that may help pay medical bills. MedPay rules vary by policy and are different from PIP.

Health Insurance: Your medical insurance can still play a major role, especially when auto benefits are limited or exhausted. Coverage details depend on the plan terms and provider network rules.

Liability Claim: A claim against the at-fault driver’s insurance for damages not covered by no-fault benefits, such as additional medical costs, lost income, and pain and suffering when legally available.

Reimbursement and Subrogation: In some cases, an insurer or medical provider may seek repayment from a settlement for bills they paid or discounted.

Not every accident involves the same billing sequence, but the table below shows a typical order of payment sources for many Utah auto accident cases.

| Payment Source | When It Commonly Applies | Practical Notes |

|---|---|---|

| Auto No-Fault Benefits (PIP) | Often early, soon after treatment begins | Ask the insurer how to open the PIP portion of the claim and what documentation they require. |

| Optional Auto Medical Coverage (MedPay) | Varies by policy and state-specific rules | May help cover gaps, deductibles, or co-pays depending on the policy language. |

| Health Insurance | Often after or alongside auto benefits | Network rules and plan approvals matter. Keep track of explanation of benefits statements. |

| At-Fault Driver Liability Insurance | Typically later, through settlement or judgment | Payment usually happens after an injury claim is resolved, not at the beginning. |

| Out-of-Pocket Payment Plans | When coverage is delayed or disputed | Get payment plan terms in writing and keep all billing statements. |

The Instagram reel below gives a quick, practical explanation of PIP versus MedPay and how these coverages can affect medical bills after a crash.

Typical Claim Steps and Timelines for Getting Bills Paid

Even when coverage exists, delays happen when the right steps are not taken early. The most reliable approach is to treat billing as a paperwork process: open the right claim, provide the right documentation, and keep your records organized.

Open the Right Claim Immediately

Report the accident to your insurer and ask specifically how to start benefits that help with medical bills. Get a claim number and the adjuster contact details.

Tell Providers How Billing Will Be Handled

Hospitals, clinics, and physical therapists may ask for auto insurance and health insurance information. Provide both when appropriate and confirm where bills are being sent.

Track Bills, Records, and Explanations of Benefits

Keep a folder with bills, payment receipts, and insurer statements. This helps identify duplicates, coding issues, and gaps that trigger collections.

Evaluate Liability and Settlement Options

If another driver is at fault, a separate liability claim may cover medical expenses beyond no-fault benefits. The timing usually depends on treatment progress, documentation, and negotiations.

For a deeper understanding of liability claims, see understanding first-party vs third-party claims in Utah. If the insurer is refusing or stalling without a clear reason, our guide on bad faith insurance practices in Utah explains warning signs to take seriously.

The video below offers practical guidance on how attorneys and clients often manage medical bills during the claims process, including what to document and what to expect from insurers.

Watch: How Medical Bills Are Handled During a Utah Injury Claim

This Instagram reel reinforces a key point many people miss: your own auto coverage may be involved in the first stage of paying medical bills after a crash.

Required Forms and Documentation to Keep Things Moving

Insurance companies and providers often ask for similar items. Providing them early can prevent billing delays and reduce the risk of accounts being sent to collections while the claim is pending.

Claim Information: Claim number, adjuster name, and the best email or fax for submitting bills.

Medical Billing Records: Itemized bills and payment history, not just balance statements.

Medical Records Release: Authorization forms may be required to confirm treatment was accident-related.

Health Insurance Documents: Explanation of benefits statements and denial letters if a bill is rejected.

Proof of Lost Income: Pay stubs and employer verification may be needed if wage-related benefits are requested.

If you are dealing with a larger injury case, it can also help to read our Utah car accident claim timelines guide to understand why settlement payment typically comes later in the process.

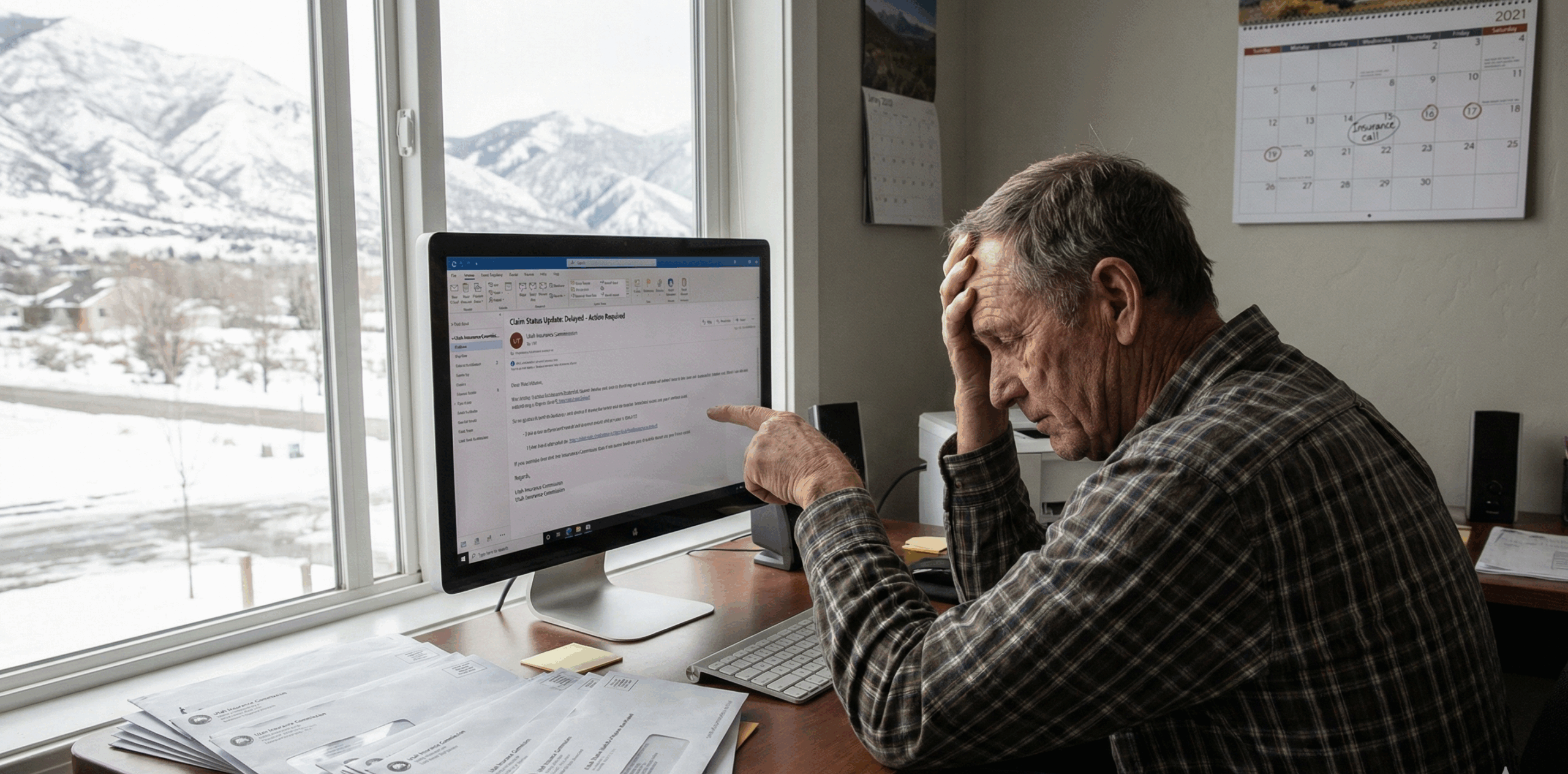

Common Mistakes That Make Medical Bills Harder to Resolve

Most billing problems come from misunderstandings about who pays first, missed paperwork, or waiting too long to contest an incorrect bill.

Not opening the correct insurance coverage: People report the crash but never ask how medical bills should be submitted, which delays payment.

Ignoring provider billing letters: Even if a claim is pending, providers may continue sending statements. Do not assume the insurer is handling it automatically.

Missing documentation deadlines: Insurers often request itemized bills, releases, or proof of treatment. Late responses can stall reimbursements.

Talking settlement too early: Settling before you understand the full medical picture can leave you paying future bills out of pocket.

Overlooking reimbursement issues: Depending on the situation, health insurance or other payors may seek repayment from settlement funds. Planning for that early matters.

The video below provides a practical overview of bill management after an accident, including documentation, negotiations, and what people often miss when they assume “insurance will just handle it.”

Watch: Practical Tips for Managing Medical Bills After an Accident

Next Steps If You Are Facing Medical Bills After an Accident

If you are getting bills you do not understand—or you are being told coverage is “denied” without a clear explanation—there are steps you can take right away to protect yourself financially.

Confirm Where Bills Should Be Sent

Call your auto insurer and ask for the best method to submit bills and medical records. Confirm the claim number and coverage details in writing if possible.

Organize Your Records

Keep copies of itemized bills, payments, and insurer letters. Organization helps identify errors and reduces delays.

Protect Your Claim

Be careful with recorded statements and quick settlement offers. If you need negotiation help, see how to negotiate a settlement with Utah insurers.

Get Legal Guidance When Stakes Are High

When injuries are serious, multiple coverages may apply and reimbursement issues can get complex. A lawyer can help clarify your options and next steps.

This Instagram clip shows the types of behind-the-scenes steps a law firm may take to help get bills organized, records collected, and the claim positioned for resolution.

Contact Gibb Law for Help With Accident Medical Bills

Gibb Law is a Utah-based firm focused on clear, practical guidance for people facing real-life legal problems. If you have questions about medical bills, coverage denials, or settlement options after an accident, we can help you understand what comes next.

Schedule a Consultation