After a Utah car crash, an insurance adjuster may contact you quickly. That first call can feel friendly and routine, but it can also shape the direction of your claim.

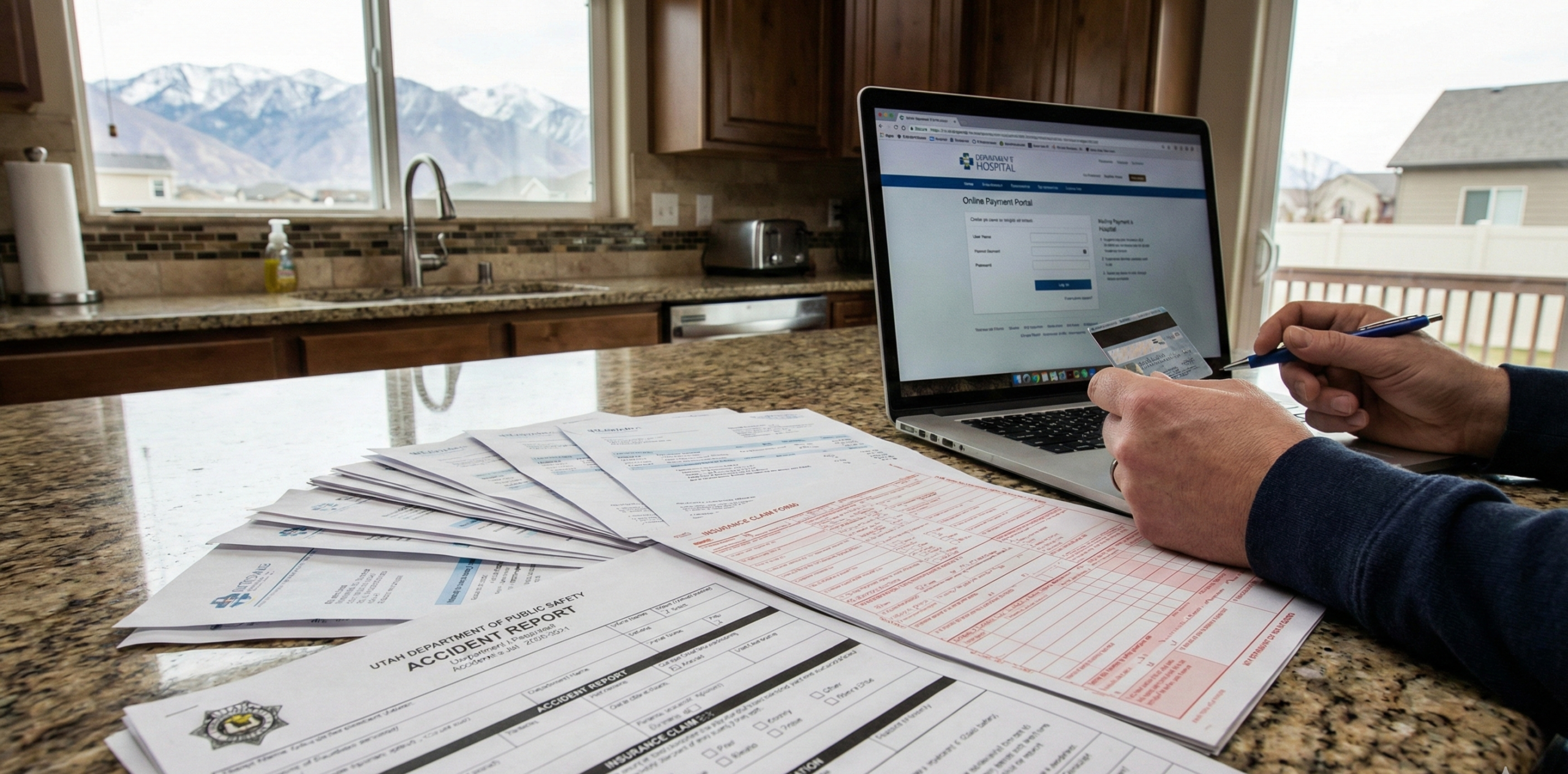

Adjusters often ask for a recorded statement, medical updates, and documentation for repairs and treatment. Some requests are normal. Others can create confusion, lead to gaps in the record, or result in a settlement offer that does not match the full impact of your injuries.

If you want broader help on car accident cases, see Gibb Law’s car accident attorney page. For a plain-English overview of how insurers evaluate claims, read how insurance companies handle car accident claims.

Note: This article is educational information, not legal advice. Coverage rules and deadlines can be strict, and the right approach depends on the facts of your crash and the available insurance.

Dealing with Insurance Adjusters in Utah

In Utah, most car accident cases begin with an insurance claim, not a courtroom. Adjusters are the people insurers assign to investigate what happened, review documents, and negotiate payment. Their decisions often come early, sometimes before you have full medical information or a complete repair estimate.

Adjusters collect information fast: Early statements and documents can influence liability, injury causation, and claim value.

Utah’s no-fault structure matters: Your own Personal Injury Protection (PIP) coverage often applies first for certain medical costs, regardless of fault.

Recorded statements can be risky: Small inconsistencies can be used later to dispute fault or the seriousness of injuries.

Offers may come before you are fully healed: Settling early can close the claim before the full picture is clear.

The video below shares practical tips for talking with adjusters after a car accident, including what to say, what not to say, and how to protect your claim.

Watch: Tips for Negotiating With Insurance Adjusters After a Car Accident

Key Definitions and Utah Laws That Shape Adjuster Decisions

Insurance adjusters use legal concepts, policy language, and Utah statutes to evaluate a claim. You do not need a law degree to protect yourself, but it helps to understand the basic terms that drive settlement discussions.

Personal Injury Protection (PIP): Utah is often described as a “no-fault” state for certain initial benefits. PIP can pay certain medical expenses and other covered losses regardless of who caused the crash.

PIP threshold concepts: Utah’s PIP statute includes limitations and conditions that can affect when a person may pursue additional damages beyond no-fault benefits.

Comparative negligence: Utah uses comparative fault rules. Adjusters may assign percentages of fault and reduce an offer based on those percentages.

Policy duties: Most policies require reasonable cooperation, but “cooperation” does not mean guessing, speculating, or agreeing to broad releases without understanding them.

If you want a deeper look at the overall claim process, see understanding personal injury claims in Utah. If you are trying to understand what drives value, see what factors determine the value of a personal injury claim.

The reel below highlights a common issue: adjusters may ask questions that sound harmless, but can steer your answers into fault or injury disputes.

Typical Claim Steps When You Are Working With an Adjuster

Most insurance claims follow a predictable path. Knowing the sequence helps you stay organized, avoid pressure tactics, and keep the record clean. The steps below are common in Utah car accident claims, even when the details differ from case to case.

Step 1: Open the claim and confirm basic coverage

Get the claim number, adjuster contact information, and the insurer’s preferred way to send documents.

Step 2: Document injuries and vehicle damage

Take photos, save repair estimates, and keep a simple record of symptoms, appointments, and work restrictions.

Step 3: Provide clear, consistent facts

Share the basic timeline and avoid guessing. If you do not know an answer, it is okay to say you will follow up.

Step 4: Review medical and repair documentation

Adjusters evaluate bills, records, and causation. This is a common point where disputes begin.

Step 5: Demand and negotiation

Once treatment and damages are documented, the claim usually moves into a demand and settlement discussion.

This Utah-focused video explains how the insurance claim process typically works and how to interact with adjusters after an accident.

Watch: Dealing With Insurance Companies After an Accident in Utah

Records and Requests Adjusters Commonly Ask For

Insurance claims are documentation-driven. Some requests are reasonable and routine. Others may be overly broad. The goal is to cooperate appropriately while protecting your privacy and avoiding accidental inconsistencies.

| Common adjuster request | Why it matters and a safer way to handle it |

|---|---|

| Recorded statement | It can lock in details early. Keep it factual, do not guess, and consider getting guidance first if injuries are serious or fault is disputed. |

| Medical authorization release | Broad authorizations can expose unrelated history. Ask what records are needed and limit the request to crash-related treatment when appropriate. |

| Repair estimates and photos | These help document property damage and impact forces. Keep copies of all estimates and any supplement requests from the shop. |

| Wage and work verification | Lost income is often challenged. Employer letters, pay stubs, and disability notes can help support the claim. |

| Settlement release | Signing usually ends the claim. Review what rights you are giving up and confirm all damages are accounted for. |

Keep everything in one place: Save emails, letters, claim notes, bills, and photos in a single folder so nothing gets lost.

Confirm deadlines in writing: If an adjuster asks for documents by a certain date, ask for that deadline by email.

Ask for clarification: If you do not understand a request, ask what it is for and how it affects the claim decision.

The reel below explains why early settlement offers can be misleading, especially when long-term medical needs are not clear yet.

Common Mistakes to Avoid When Talking With an Adjuster

Most claim problems are not caused by one big mistake. They come from small issues that build over time, like missing records, inconsistent statements, or signing documents too early.

Guessing about speed, distance, or timing: If you are not sure, say so. Estimates can be used later to challenge credibility.

Downplaying symptoms: Many injuries evolve over days. Be honest and keep your medical providers updated.

Posting about the crash on social media: Public posts can be taken out of context and used in settlement talks.

Accepting the first offer without analysis: An early offer may not account for future care, time off work, or ongoing limitations.

Signing a release without understanding it: A release can waive claims you did not intend to waive.

This video explains negotiation tactics and why it helps to get settlement terms in writing as the claim moves forward.

Watch: How to Negotiate With an Insurance Adjuster

Next Steps if You Feel an Adjuster Is Not Being Fair

If you feel pressured, confused, or boxed into statements you did not mean, slow the process down. A checklist approach can help you protect your claim and keep the record clear.

Move important communications to email: Written communication reduces misunderstandings and creates a clean paper trail.

Request a written explanation: If an offer seems low, ask what documents and assumptions were used to calculate it.

Organize your evidence: Keep photos, records, bills, wage loss documents, and provider notes together and easy to reference.

Do not sign broad releases under pressure: Ask for time to review paperwork and confirm what the release covers.

Talk to Gibb Law About a Utah Insurance Claim

Gibb Law is a Utah-based firm focused on clear, practical guidance for clients facing real-world legal problems. If you are dealing with insurance adjusters after a crash, we can help you understand your options, organize the right documentation, and push for a resolution that fits the facts of your case.

Schedule a Consultation