After a crash, most people want a straight answer to one question: what is this claim worth. In Utah, the value of a car accident case is typically based on the damages you can document and prove, along with how fault and insurance rules apply to your situation.

In plain English, damages are the losses caused by the collision. That can include medical bills, lost income, vehicle damage, and non-economic harm like pain and suffering. In some cases, Utah’s no-fault rules and comparative fault rules can also change what you can recover and when.

Note: This article is educational information, not legal advice. The right way to value a claim depends on the facts, coverage, medical documentation, and deadlines in your case.

Explore Related Utah Car Accident Resources

If you are building a claim, these related guides on Gibb Law Firm’s site can help you understand fault, coverage, timing, and what to do next.

How Damages Are Calculated in a Utah Car Accident Claim

Most Utah car accident claims are valued by adding up documented financial losses and then evaluating non-economic harm. If fault is shared, the total may be reduced based on percentage of fault. If the claim is resolved through insurance, the process usually happens through negotiation. If a lawsuit is filed, damages may be proven through records, testimony, and expert opinions when needed.

Economic damages: Out-of-pocket and measurable losses such as medical bills, lost wages, and future medical costs that can be supported with records.

Non-economic damages: Human losses that are harder to measure, like pain and suffering, emotional distress, and loss of enjoyment of life.

Property-related losses: Vehicle repair or total loss value, towing, storage, and sometimes rental costs depending on coverage and claim posture.

Future impacts: Ongoing treatment, long-term limitations, and future lost earning capacity may be part of damages when they are supported by credible documentation.

The video below walks through the basic categories that often apply in car accident cases, including the difference between economic and non-economic damages.

Watch: How Personal Injury Damages Are Calculated

One point that surprises people is how much documentation drives value. A claim is not valued by what feels fair. It is usually valued by what can be proven and connected to the collision with records and a consistent timeline.

The short reel below highlights what people often mean by “actual damages” and why prior conditions and medical documentation can affect recovery.

Key Definitions and Utah Statutes

Damages are calculated inside a legal and insurance framework. In Utah, a few statutes commonly affect what a car accident claim can include, how fault impacts value, and how long you have to file suit.

Compensatory damages: Money meant to repay losses caused by the crash, including both economic and non-economic losses.

Comparative fault: Utah uses a modified comparative fault system that can reduce damages based on a person’s share of fault and can bar recovery when fault is too high. See Utah Code Section 78B-5-818.

No-fault threshold basics: Utah’s no-fault rules (including serious injury thresholds) can affect when someone may pursue certain damages beyond personal injury protection. See Utah Code Section 31A-22-309.

Time limits for filing: Many personal injury lawsuits must be filed within a specific limitations period. See Utah Code Section 78B-2-307 for certain injury claims, and Utah Code Section 78B-2-305 for certain property-related claims.

Punitive damages: In some cases, punitive damages may be discussed, but they are not automatic and typically require a higher showing than ordinary negligence. See Utah Code Section 78B-8-201.

This legal framework matters because it controls the math and the timeline. Even when the facts seem straightforward, coverage rules, fault arguments, and deadlines can change what damages are realistically available.

Typical Claim Steps and How Insurers Value Damages

Most Utah car accident cases begin as insurance claims, not lawsuits. The damages figure often takes shape in stages as records come in. A structured process helps you avoid undervaluing the claim early, before the full picture is clear.

Step 1: Immediate documentation

Crash report information, photos, witness names, and a clear timeline help establish what happened and reduce disputes that can reduce value.

Step 2: Medical treatment and records

Medical bills and treatment notes are often the foundation of a damages analysis. Gaps in care can create causation disputes.

Step 3: Wage and work impact proof

Pay stubs, employer verification, and documentation of missed work support lost wages and future earning issues when applicable.

Step 4: Demand package and negotiation

Many claims are resolved by presenting a documented demand and negotiating value based on damages, fault arguments, and coverage.

Step 5: Litigation and formal damages proof

If a case is filed, damages may be proven through records, testimony, and expert opinions when needed. Fault findings can also reduce the final number.

The video below discusses what a Utah car accident claim may be worth and why medical bills, wage loss, and other factors change settlement value.

Watch: What a Car Accident Claim May Be Worth

Insurance companies often begin shaping their defense early. That can include challenging treatment, minimizing the seriousness of injuries, or pushing fault arguments. Being organized from the start helps you respond with records instead of guesswork.

The reel below highlights how insurers start building their position, and why a claimant should build their documentation with the same seriousness.

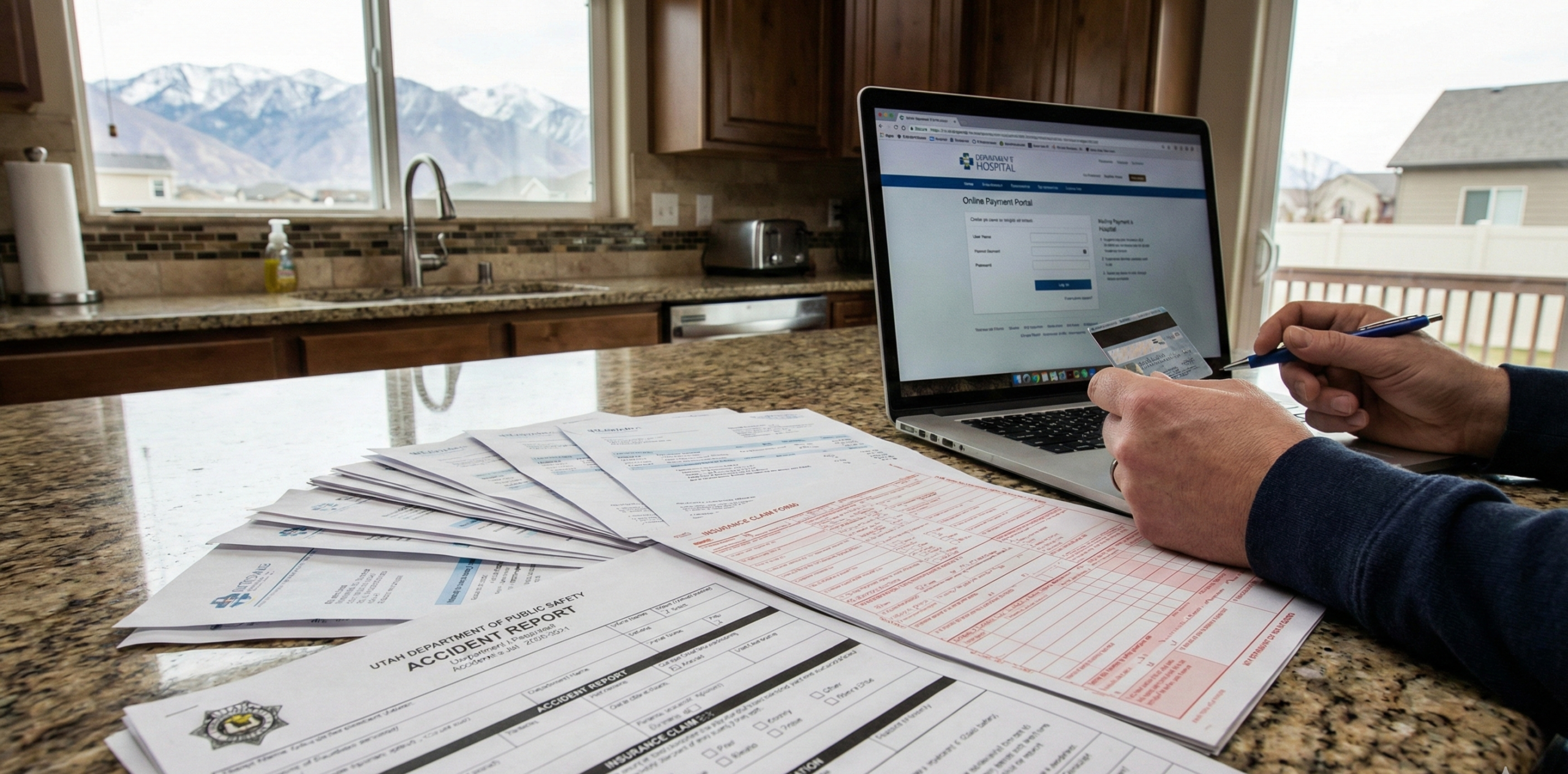

Records and Paperwork That Support a Full Damages Calculation

Damages are not just numbers. They are supported by paperwork. If documentation is missing, it is easier for an insurer to argue that a loss is inflated, unrelated, or unsupported.

Crash report and scene documentation: Photos, diagrams, and witness information can help with both fault and causation.

Medical bills and records: Itemized billing, treatment notes, diagnostic imaging, and referrals help show what care was needed and why.

Wage loss proof: Employer verification, tax documents when relevant, and a clear record of missed time and reduced capacity.

Vehicle and property documentation: Repair estimates, total loss valuation, towing and storage receipts, and rental documentation if applicable.

Personal impact notes: A simple symptom and limitation log can help explain pain levels, sleep disruption, mobility limits, and missed activities.

| Damages category | Common records that support it |

|---|---|

| Medical expenses | Itemized bills, EOBs, treatment notes, referrals, imaging results, and therapy records. |

| Lost wages | Employer letter, pay stubs, PTO records, disability paperwork, and documentation of time missed. |

| Pain and suffering | Consistent treatment timeline, symptom log, and records showing functional limitations. |

| Vehicle damage | Repair estimates, total loss report, photos, receipts for towing and storage, and rental documentation when applicable. |

| Future care and impacts | Provider recommendations, projected treatment plan, and documentation supporting lasting limitations. |

Common Mistakes That Can Reduce Damages Value

Many claim value problems come from avoidable mistakes. The good news is that most of them can be prevented with a careful, steady approach and clear documentation.

Waiting too long for medical care: Delays can create arguments that injuries were not caused by the crash or were not serious.

Not tracking expenses: Out-of-pocket costs add up. Keep receipts and a simple list of crash-related spending.

Giving inconsistent descriptions: Differences between what is said to police, providers, and insurers can be used to dispute causation.

Settling before the full picture is clear: Early offers may not account for follow-up care, therapy, or longer recovery time.

Overlooking fault arguments: If fault is disputed, damages can be reduced. Understanding the fault framework matters.

The reel below is an example of how real-world outcomes can vary based on damages and case development. The point is not that every case looks like this, but that documentation and strategy can meaningfully affect results.

Next Steps to Protect and Document Your Damages

If you want your claim value to reflect what actually happened, the goal is to stay organized and build a clean paper trail. This is especially important when injuries are ongoing or when the insurer is disputing value.

Create a simple damages file

Keep bills, receipts, repair estimates, and wage loss documents in one place so nothing is missed.

Follow through on treatment

Consistent care supports causation and helps show the real impact of the injuries over time.

Be careful with insurer communications

If you feel pressured to accept an early number, slow down and make sure you understand what the release would cover.

Confirm deadlines and thresholds

Time limits and no-fault thresholds can change the path of a claim. Missing a deadline can end options.

The video below provides a lawyer-led explanation of how car accident settlements are calculated and what factors commonly influence valuation.

Watch: How Car Accident Settlements Are Calculated

Talk to Gibb Law About Damages in a Utah Car Accident Case

Gibb Law is a Utah-based firm focused on clear, practical guidance for clients facing real-world legal problems. If you are trying to understand what damages may apply in your car accident claim, or you are getting pressure to settle before the full picture is clear, we can help you evaluate documentation, deadlines, and next steps that fit your situation.

Schedule a Consultation