Utah Car Accident Claim Timelines Explained: After a crash, most people want one simple answer: how long will this take? Timelines vary, but the steps are usually predictable. Knowing what happens next can help you avoid delays and protect key Utah deadlines.

Most claims move through the same phases: reporting the accident, getting medical care, opening insurance claims, gathering records, negotiating, and (when needed) filing a lawsuit before time runs out. Where cases slow down is usually missing documents, disputed fault, gaps in treatment, or coverage problems.

For related Utah resources on the firm site, you may also want to read what to do after a car accident in Utah, filing a police report after an accident in Utah, understanding Utah’s no-fault insurance rules, and how fault is determined in Utah car crashes.

Note: This article is educational information, not legal advice. Deadlines and strategy can change based on the facts, insurance policies, and who is involved.

Utah Car Accident Claim Timelines Explained

A Utah car accident claim is not one single deadline. It is a sequence of deadlines and checkpoints. Some are legal (like statutes of limitation). Others are practical (like how long it takes to get medical records, repair estimates, or an insurance decision).

The first 24 to 72 hours: Report the crash, document the scene, and get medical care if you are injured. Early records often become the backbone of the claim.

The first 2 to 4 weeks: Insurance claims get opened, the crash report becomes available, and treatment plans start to form. This is where many avoidable delays happen.

The next few months: Evidence and records are gathered, injuries and future care are evaluated, and settlement negotiations usually take place.

When a case goes longer: Disputed fault, serious injuries, multiple vehicles, uninsured drivers, or a lawsuit can extend the timeline significantly.

The video below gives a clear, general overview of what can affect how long a car accident settlement takes. It is not Utah-specific, but the stages described match what most people experience during the claim process.

Watch: How Long Does a Car Accident Settlement Take

In Utah, many claims start under the state’s no-fault framework. That means certain benefits may be paid through your own coverage first, even when another driver caused the crash. Claim timelines often depend on when medical treatment stabilizes and when records are complete enough to evaluate the full impact of the injury.

Key Definitions and Utah Deadlines That Control the Timeline

There are two timelines to understand: the insurance timeline (how long adjusters take to investigate, negotiate, and pay) and the legal timeline (how long the law gives you to file in court). The legal timeline matters even if you hope to settle.

Insurance claim: A request for benefits or payment under an insurance policy, such as no-fault benefits, property damage coverage, or a liability claim against an at-fault driver.

Settlement demand: A written request that summarizes liability, injuries, damages, and includes supporting documents to justify a specific dollar amount.

Statute of limitations: A deadline to file a lawsuit. Utah has different limitation periods depending on what is being claimed and who is involved.

Government-related claims: If a governmental entity may be involved, special notice deadlines can apply and can be shorter than people expect.

Even when you are negotiating in good faith, insurance companies do not have to keep negotiating forever. If a lawsuit needs to be filed to protect your rights, it must happen before the correct deadline runs out. That is why it is risky to treat a claim timeline like an open-ended conversation.

The video below focuses on Utah filing deadlines and is helpful for understanding why waiting too long can cause a legal problem, even if you are still talking with an adjuster.

Watch: Utah Statute of Limitations for Car Accident Claims

Typical Claim Steps and What Each Step Does to the Timeline

Most cases begin with insurance. Some resolve before a lawsuit is ever filed. Others require litigation because the parties cannot agree on fault, the value of injuries, or available coverage.

Step 1: Report the crash and start the paper trail

This includes exchanging information, documenting the scene, and getting a crash report when available. Early documentation helps avoid disputes later.

Step 2: Medical evaluation and follow-up care

Treatment timing matters. Delays can create arguments about whether injuries were caused by the crash.

Step 3: Open insurance claims

This often includes a claim through your own insurer and, when appropriate, a liability claim against the other driver’s insurance.

Step 4: Gather records and document damages

Medical records, bills, wage information, and repair estimates often control the pace. Missing records slows everything down.

Step 5: Negotiate, then decide whether a lawsuit is needed

If negotiations stall or deadlines are approaching, filing in court may be the safest way to protect the claim and keep the process moving.

The short reel below walks through what many people experience after they file a claim. It is a useful reality check for why claims can feel slow even when things are moving behind the scenes.

The video below adds more context on how long personal injury claims can take in general, and why complex cases often take longer than people expect.

Watch: How Long Do Car Accident Injury Claims Take

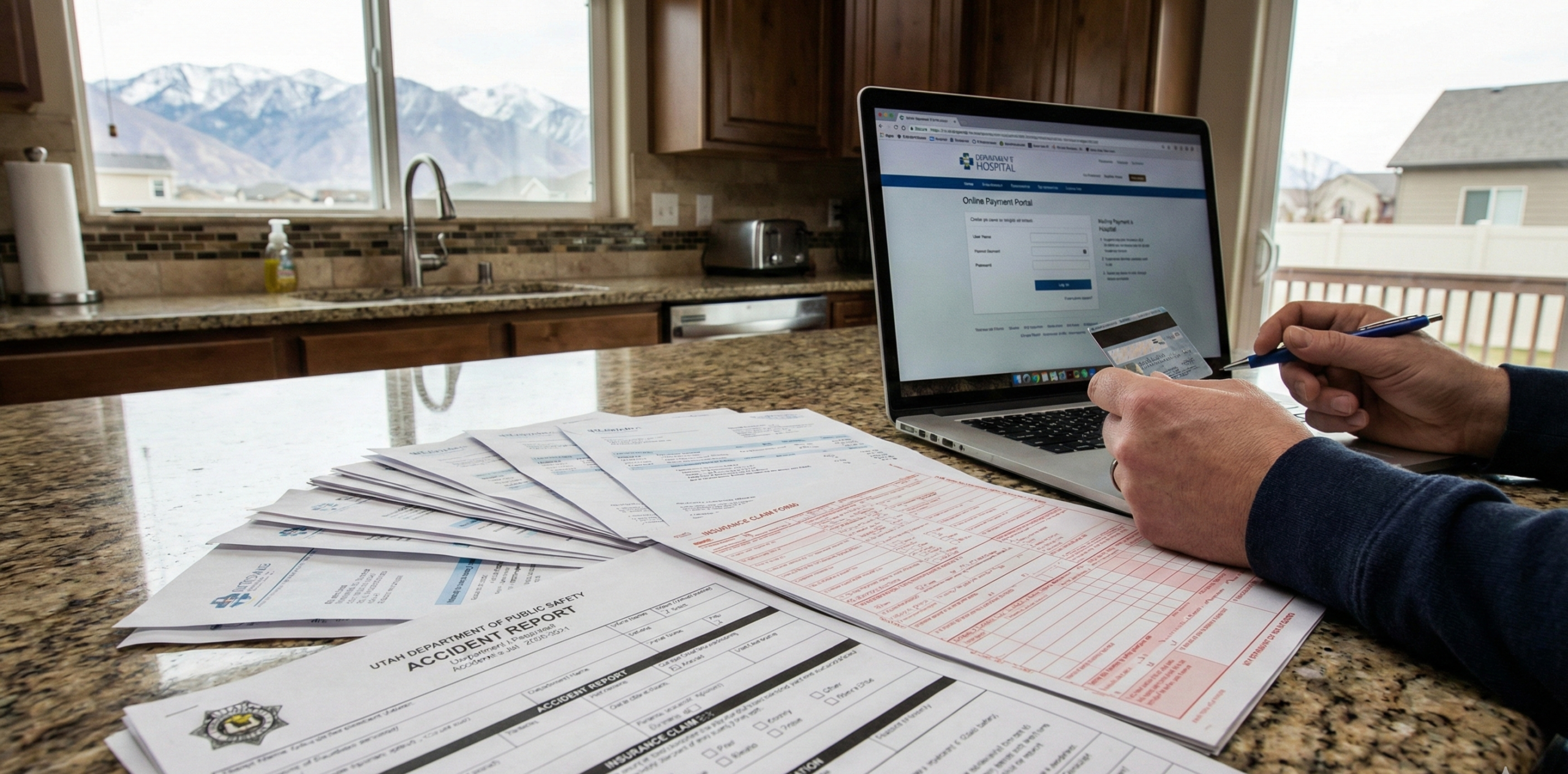

Records and Paperwork That Keep a Claim Moving

Timelines usually improve when the claim file is organized. That does not mean you need to be perfect. It means you keep the essentials together so the insurer cannot delay by repeatedly asking for the same items.

Crash documentation: Photos, insurance info, witness names, and the crash report number when available.

Medical records and bills: Emergency care, follow-up visits, therapy, imaging, and prescriptions. A consistent treatment timeline helps show causation.

Wage loss documentation: Pay stubs, time-off records, and a note from your employer confirming missed work and lost income.

Repair estimates and receipts: For vehicle repairs, towing, rental, and related out-of-pocket costs.

| Timeline point | What usually helps avoid delays |

|---|---|

| Opening the claim | Accurate contact info, clear accident date and location, and quick delivery of available crash details. |

| Medical documentation | Consistent treatment and complete provider lists so records can be requested without gaps. |

| Property damage processing | Photos plus a written estimate. Total loss situations can add steps like valuation review and title paperwork. |

| Demand and negotiation | A clear demand package that ties injuries to the crash and includes records, bills, and wage proof. |

| Approaching deadlines | Identify the correct filing deadline early and reassess well before it is close. |

Common Mistakes That Slow Down a Claim

Many long timelines come from a small number of problems. Most are preventable once you know what to watch for.

Waiting too long for medical care: Delays can create disputes about whether the crash caused the injury.

Missing documents: A claim cannot be evaluated well without records, bills, and proof of losses.

Giving a recorded statement without preparation: Inaccurate details can create liability fights that slow everything down.

Settling too early: If treatment is ongoing, an early settlement can undervalue future care and leave you paying later costs yourself.

Losing track of deadlines: Negotiations do not pause legal deadlines. Missing a deadline can end the case.

Low settlement offers are a common reason claims drag on. The reel below addresses what it can look like when an insurer starts low, and why documentation and negotiation strategy matter.

Next Steps

If you want the claim to move efficiently, focus on two things: strong documentation and awareness of deadlines. You do not need to be aggressive. You do need to be organized and consistent.

Create a simple claim folder

Keep photos, claim numbers, adjuster contacts, and receipts in one place so you can respond quickly.

Track medical providers and dates

Write down where you treated and when. This helps record requests stay complete and avoids gaps.

Ask what the insurer still needs

A direct question can uncover missing records, unclear wage proof, or an estimate issue that is stalling progress.

Recheck deadlines before the last minute

If negotiations are not moving, you may need a different strategy to protect your rights before time runs out.

The reel below gives a step-by-step look at how a personal injury claim can progress from treatment to evidence to settlement discussions.

Talk to Gibb Law About a Utah Car Accident Claim Timeline

Gibb Law is a Utah-based firm focused on clear, practical guidance for real-world legal problems. If you are dealing with claim delays, disputed fault, low offers, or concerns about deadlines, we can help you understand the process and identify next steps that fit your situation.

Schedule a Consultation