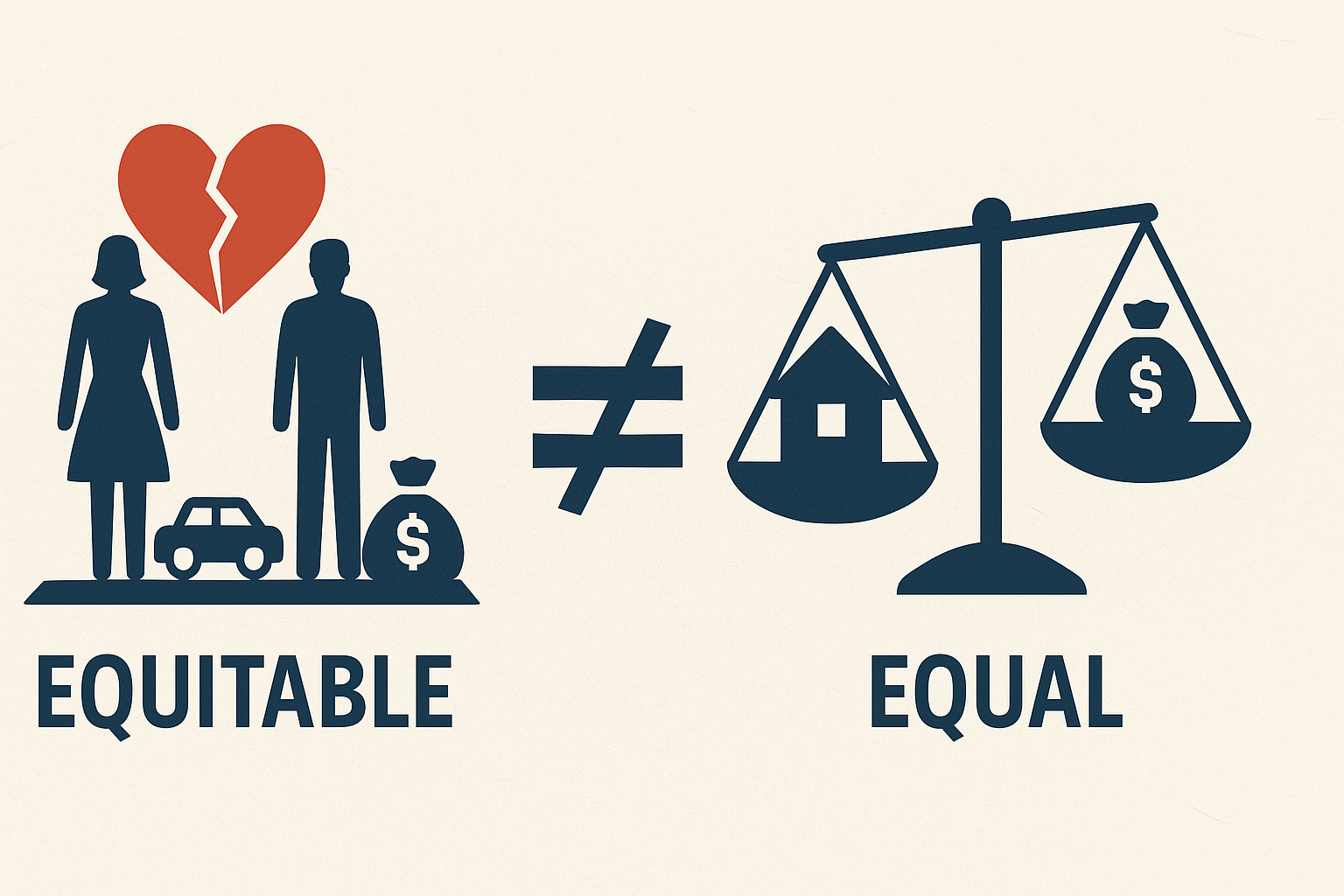

When Utah couples divorce, one of the most complex and emotionally charged steps is dividing property. Utah follows an “equitable distribution” system, meaning assets are divided fairly but not necessarily equally. “Equitable” focuses on fairness under the circumstances, not an automatic 50/50 split.

At Gibb Law Firm, we help clients understand how Utah’s laws apply to their situation, ensuring property division outcomes are both just and legally sound.

Understanding Equitable Distribution in Utah

Utah’s equitable distribution rule is based on fairness rather than strict equality. Courts consider each spouse’s income, the length of the marriage, contributions to the household, and future earning potential. Judges also determine whether property is marital or separate.

Marital property includes assets and debts acquired during the marriage, regardless of whose name is on the title.

Separate property usually refers to assets owned before the marriage or received as gifts or inheritances.

Commingling can convert separate property into marital property if it is mixed with joint assets or used for marital purposes.

Watch: Utah Property Division Principles

This quick overview lays the groundwork for how Utah judges think about fairness and classification before dividing assets.

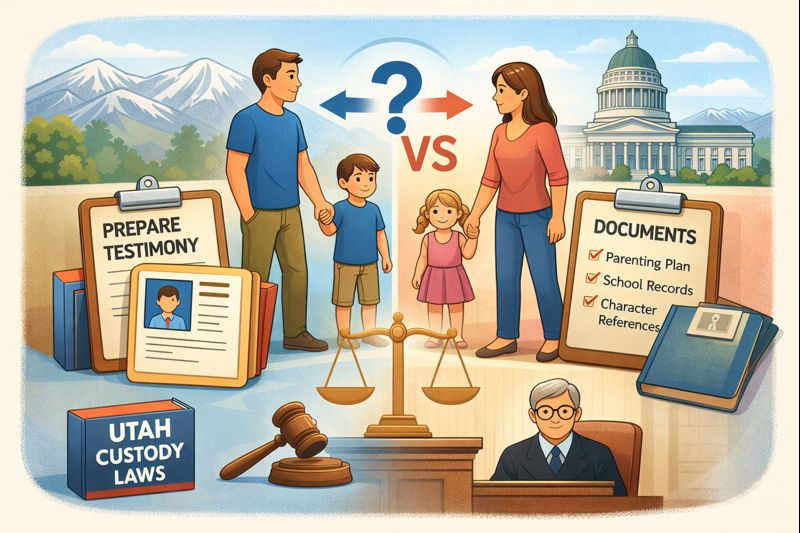

How Courts Divide Property in Utah Divorce Cases

When a Utah divorce involves property or debt, the court generally follows a multi-step process:

Identification

Both spouses must provide a full list of assets and debts, from homes and vehicles to retirement accounts and credit card balances.

Classification

The judge determines which items belong to the marital estate and which remain separate.

Valuation

Assets are valued as close as possible to the date of the divorce decree to promote fairness.

Distribution

The court divides assets and debts equitably based on the parties’ circumstances.

Watch: Division of Assets and Debts in Utah

See the identification, classification, and valuation steps in action so you know what documents to prepare.

Key Utah Statutes and Legal Definitions

Property division in Utah is primarily guided by provisions in Utah Code Title 30 (Husband and Wife). Courts have discretion to reach a fair outcome, and fair does not always mean equal. In some cases, one spouse may receive a larger share to offset financial disadvantages, such as leaving the workforce to raise children or having significantly lower earning potential.

Quick explainer: Equitable vs. equal

This short reel illustrates why Utah focuses on fairness under the circumstances instead of a rigid 50-50 split.

Common Mistakes to Avoid

Failing to disclose everything: Omitting assets or debts can derail your case and damage credibility.

Assuming an automatic 50/50 split: Utah focuses on fairness, not a strict equal division.

Ignoring tax consequences: Retirement accounts and real estate often carry significant tax impacts.

Leaving joint credit open: Close or refinance joint lines to prevent future liability.

Visual checklist recap

Before you negotiate, skim this 30-second reel covering the most frequent pitfalls in Utah property splits.

Special Considerations: The Marital Home and Debt

The family home often becomes the centerpiece of property division disputes. Courts consider who will live there, whether it should be sold or refinanced, and how equity is divided. Debt division is not necessarily tied to income; judges look at fairness and why the debt was incurred.

Homeownership & Mortgages

Options include sale with split proceeds, refinance to buy out equity, or deferred sale tied to children’s schooling.

Debt Allocation

Courts may assign debts equitably based on purpose, benefit to the marriage, and each party’s ability to pay.

Watch: Does Income Impact Debt Division In Divorce?

Learn how Utah judges weigh purpose of the debt, benefit to the marriage, and ability to pay when splitting liabilities.

Who keeps the house?

This reel walks through factors like stability for children, refinance feasibility, and equity offsets that often drive outcomes.

Required Forms and Procedures

File the Case

Submit a Petition for Divorce (Utah’s Online Court Assistance Program provides guided filing tools).

Financial Disclosure

Complete a Financial Declaration listing assets, debts, income, and expenses with supporting documents.

Mediation

Mediation is required in most contested cases and can resolve division issues efficiently.

Divorce Decree

Ensure the final decree clearly states how each asset and debt is divided and who must take follow-up actions.

Incomplete or inaccurate forms can delay your case or cause enforcement problems later.

What Comes Next

Property division does not end with the decree. Protect your financial future by executing the ordered follow-ups: transfer titles, close joint accounts, update beneficiaries, and complete any QDROs or deed work. Align each step with the court’s orders to prevent future disputes.

Talk to Gibb Law Firm About Property Division

Have questions about marital vs. separate property, commingling, or how Utah judges divide assets and debts? Our family law team can help you move forward with clarity.

Schedule a Consultation